The success of an automatic lubrication system installed by SKF/Lincoln on two refuse compactor trucks resulted in increased uptime, machine availability and personnel safety, urging the satisfied customers to call for the same lube solution on three more trucks.

According to SKF/Lincoln’s Application & Export Sales Engineer, Donatien Makopo, this was a new project for SKF/Lincoln. “We are extremely proud of the fact that our first compactor refuse truck lubrication installation impressed not one but two customers, a renowned truck manufacturer as well as a prominent crane builder.”

Makopo explains that the customers’ initial practice to manually lubricate all grease points on the refuge compactors caused two main problems. “In addition to some points being overlooked as they were covered in dirt, over-greasing was causing breakdowns and subsequent costly downtime. Over-greasing also led to unnecessary grease wastage which added to the customer’s costs. Already familiar with the brand due to lubrication installations having been done previously by a SKF’s Authorised Distributor in Cape Town, the customer approached us to assist them with an automated lubrication solution.”

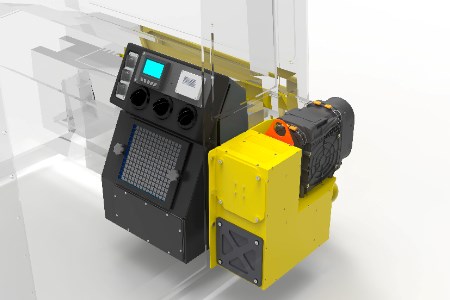

“We did not hesitate in recommending the SKF/Lincoln progressive lubrication system with P203 & KFGS1 pumps as the best solution for our customers. In addition to the fact that the units are easy to maintain, readily available stock mitigates shortages in the supply of pumps and SSV lubricant/grease metering devices.” Makopo adds that alongside proven product quality and reliability, price competitiveness was also key in securing the order.

The new generation P203 Quicklube pump can lubricate up to 250 lube points and is the answer for small to mid-sized machines and systems. The pump is equipped with numerous product advantages as standard including weather-resistant pump housing material not susceptible to UV rays, a larger filling port for easy filling of the reservoir and a strong “Polar” stirring paddle that ensures good lubricant mixing, even at temperatures of up to -40° C. Moreover, the pump is IP6K9K protected against damage and moisture.

The proven SSV progressive lubricant metering device in solid block construction is easy to monitor and delivers a high operating pressure ensuring optimum reliability even at temperatures below freezing. Featuring a maximum operating pressure of 350 bar, these piston metering devices reliably divide the incoming lubricant in predetermined individual quantities. As the devices are not fitted with fault-prone rubber seals, they can be used with high backpressures, making them ideally suited to a wide range of temperatures.

SKF/Lincoln received the first order to fit automatic lube systems on two refuse compactor trucks on 12 May 2022. Despite a few delays on the customer’s side, both trucks were completed on 27 May 2022. The project was a joint venture between the SKF/Lincoln team in Johannesburg who completed the installations at the customer’s premises. The trucks were transported to KwaZulu-Natal for final commissioning by the local SKF/Lincoln team and then delivered to the Durban customer.

Due to the success of the first project, the customers placed a repeat order on 14 June 2022 for the fitment of three more trucks. We again faced some delays from the customer’s side but we still managed to successfully complete installation and commissioning of all three trucks within six weeks,” concludes Makopo.