Copper, Gold, Newcrest, Newmont, News, Takeover bids

Newmont makes “best and final” offer for Newcrest

Newmont has raised its takeover bid for ASX-listed Newcrest to $29.4 billion, which the US gold giant has labelled its best and final proposal.

The revised offer would see Newcrest shareholders receive 0.400 Newmont shares for each Newcrest share held, with an implied value of $32.87 per share for an overall valuation of $29.4 billion.

This is an increase from a previous indicative proposal in February of 0.380 per share, totalling roughly $24.5 billion, which Newcrest rejected on the grounds that it failed to properly value the company.

The company previously rejected an earlier offer of 0.363 per share.

Newcrest has kept relatively quiet about the new offer; however, it has granted Newmont exclusive due diligence access, essentially allowing a thorough review and audit of all relevant financial information which, when completed, will enable Newmont to put forward a binding proposal.

If a future takeover offer is accepted by shareholders, it will make Newcrest – already the largest listed gold company in the world – a veritable titan.

“We are entering a new era in which mining companies must hold themselves to a higher standard of sustainability and long-term value creation,” Newmont chief executive officer Tom Palmer said.

“This transaction would strengthen our position as the world’s leading gold company by joining two of the sector’s top senior gold producers and setting the new standard in safe, profitable and responsible mining.

“Together as the clear gold-mining leader, we would be well positioned to generate strong, stable and lasting returns with best-in-class sustainability performance for decades to come.”

Australian-born Palmer has run Newmont since 2019. The US company already produces seven million ounces of gold per year, more than three times the amount of Newcrest.

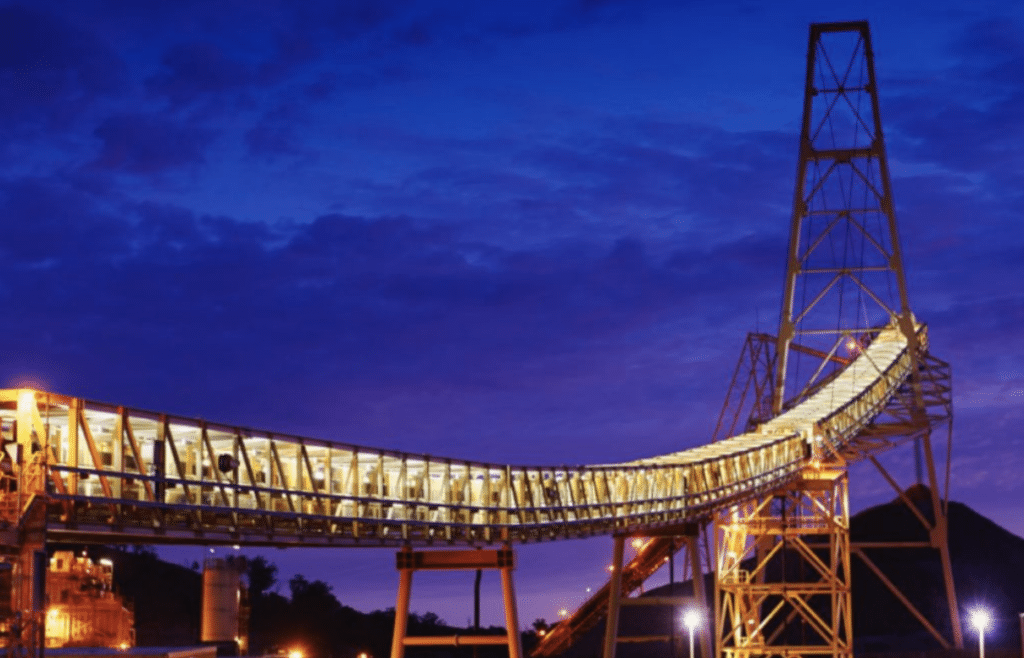

Newcrest – originally a Newmont subsidiary spun off in the 1960s – operates mines in Australia, Canada and Papua New Guinea, with the latter including the notable Lihir mine, one of the largest gold mines in the world.

Bagging Newcrest would also further strengthen Newmont’s copper portfolio, increasing annual copper production and adding almost 23,000 tonnes of copper reserves and resources to its asset base.